Strategic

Asset Management

Emailed January 5, 2010

I'm sorry. This time it really is different. It's the debt stupid.

| Hello all:

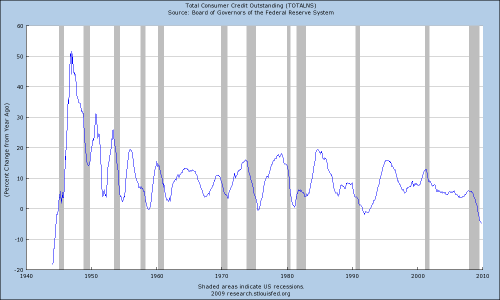

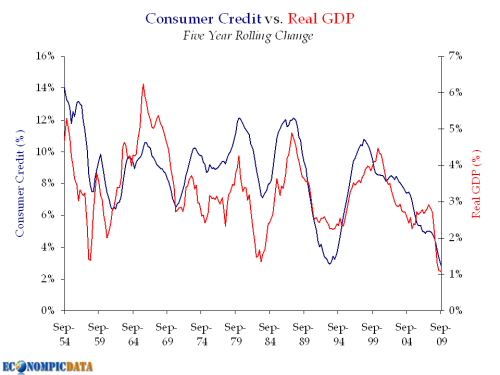

This recession is different this time, it really is. Since World War II all the previous recessions came about because of overproduction. Companies would slow down production, bring inventories back into line, and the economy would resume its upward trajectory. What allowed the economy to recover and resume its growth so quickly? Credit. The consumer kept borrowing. (See graph #1) Even during nasty recessions, consumer credit outstanding merely leveled off and did not decline significantly. This time its different. The rate of consumer credit outstanding continues to decline and is not leveling off. This does not bode well for long term GDP growth as you can see from graph #2 So why is the consumer not borrowing more? He can't! The home equity line of credit has been cut off, credit card lines have been slashed, and the the consumer is feeling a lot less wealthy after watching his house fall in value by at least 20% An unemployment rate of 10+% does not help either. As you can see consumer credit growth has

been highly correlated to GDP growth. (Thanks to the blog Econopicdata

for graph #2.) What could cause this relationship to

decouple? If you continue to see numerous stimulus programs

from the government in an attempt to restart growth you may see

GDP growth languish while consumer credit continues to decline. Politicians from both parties will try to create jobs by stimulus packages. In my opinion the numerous stimulus programs will fail to reignite any serious growth. It's the debt, stupid. (To alter a phrase from Bill Clinton in 1992) The Federal government will be able to convert some of the private debt into public debt (the various mortgage modification programs and the bailout of Freddie Mac and Fannie Mae are examples) but until the total debt ratio drops we will remain in a period of volatile sub par economic growth. Unfortunately doing what needs to be done in my opinion will be politically unpopular. Some countries in the world 'get it' and have already started the painful process of rebalancing their economy. Ireland has recently announced pay cuts of 5-15% along with numerous budget reductions. (NY Times story, 2009 December 10) (Irish times budget details) Take a quick look at the budget details. Can you imagine the same happening in America? Is this even within the lexicon of either party? Fortunately we are not (yet) in the same financial situation as Ireland but their response of reducing spending versus the US Governments reaction of spending more are polar opposites. You can't cure too much debt with more debt. Even stopping the growth of government and promising to spend the same amount each year (on a nominal basis) would work since America has more financial flexibility than Ireland; but this is unlikely. For a more detailed description of debt

dynamics I strongly suggest you read this blog

entry by an Australian economist. He does a much better

job of describing the situation of how long term credit growth

eventually creates severe economic instability.

Finally, an apology to my clients. Before the credit crisis of 2008 I basically ignored large scale macro economic matters because I didn't need to look at it. I did a pretty good job picking individual stocks and only looking at how some macro factors affected those individual stocks. I was good at what I did and did not need to leave the sandbox I was playing in. While on a risk adjusted and relative basis I outperformed in 2008 (and before) I'm still not pleased. Metaphorically speaking I feel like I was hit in the back of the head with a baseball bat and then run over by a large truck several times. This downdraft was different and I needed to know why. It has taken several months of homework but I think I'm getting a feel for what may happen in the future. I continue to be conservatively invested leaning towards strong balance sheets, avoiding the US consumer and with an international bias. As always, if you have any questions regarding my portfolio construction or this email please feel free to contact me. |

--Greg

|

|

|

|

(253) 927-0998 |

Strategic Asset

Management |

|

Strategic Asset Management is a fee only financial advisor intent upon providing its clients with independent and unbiased advice. PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. Note: This communication is not an offering for any investment. Greg Merrill is President of Strategic Asset Management which is an investment advisory firm registered in Washington State.

|

|

| Strategic Asset

Management voice: 253-927-0998 email: solutions@sasm.com Strategic Asset Management is an investment advisory firm registered in Washington State. |

For Email Marketing you can trust

|

|||||||||||||