Strategic

Asset Management

Emailed 05/04/09

Gazing into my crystal ball

| Hello all:

I have found that knowing what to avoid

is almost more important than knowing what to invest in. As

recent history painfully reveals, avoiding the serious land mines

can save a portfolio from utter ruin. Here goes:

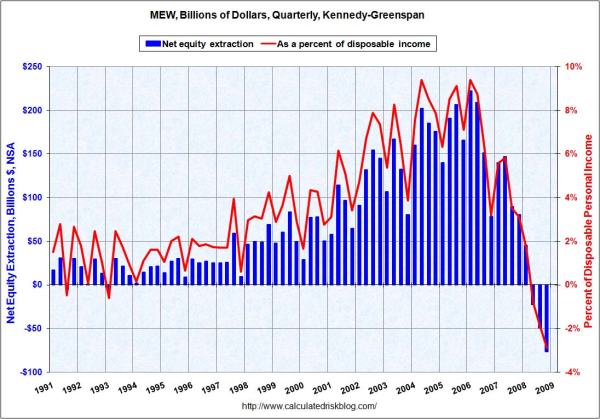

The US consumer is out of money, avoid the US consumer. As a whole, consumers have over spent and over borrowed themselves into a very deep hole and will spend the next several years rebuilding their balance sheet. The chart provided by calculatedriskblog.com helps to explain the previous predictions. The US consumer has borrowed and spent money against an asset that is now worth much less. This will reduce future home sales and put a lid on homes prices as people are unwilling to sell at a loss and as such wait for prices to rise. Less equity in ones home also makes people feel poorer and less likely to spend. This recession is unlike any other ever seen. A massive credit deflation paired with extreme stimulus by the Federal Reserve is something extraordinary. None of the standard rules of thumb will work so when you read in the paper 'it happened like this last time so it will do so again', discount the conclusions. This may sound like a rather odd prediction that it is 'different this time' but this time, it is. Energy prices will not stay low. The worldwide oil supply needs constant long term investment to replenish the older oil reserves that are on the 'downslope' of their production curve. With oil prices low and capital expensive, the drilling and exploring happening right now is not enough to replenish the expiring reserves. Once the economy picks up again world demand will run straight into that declining supply with a vengeance. While these predictions are not pleasant I thought it important for you to hear them. Advising people doesn't mean only giving them good news and rosy predictions. There's an opportunity for gains even in a recession and the above conclusions create the framework for those profits. As always if you have questions about the above predictions or about my strategies going forward please contact me. |

--Greg

|

|

|

|

(253) 927-0998 |

Strategic Asset

Management |

|

Strategic Asset Management is a fee only financial advisor intent upon providing its clients with independent and unbiased advice. PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING. Note: This communication is not an offering for any investment. Greg Merrill is President of Strategic Asset Management which is an investment advisory firm registered in Washington State.

|

|

| Strategic Asset

Management voice: 253-927-0998 email: solutions@sasm.com Strategic Asset Management is an investment advisory firm registered in Washington State. |

For Email Marketing you can trust

|

|||||||||||||